A structured phonics programme puts a strong emphasis on reading and writing skills, ensuring that most pupils exceed the expectations.

Explore-

▸

Nursery & Pre-Prep

-

▸

Prep

Beyond the curriculum we encourage our pupils to take on responsibility and they thrive on Leadership opportunities.

Explore -

▸

Senior

At St Lawrence College we offer a supportive, caring and challenging environment, founded on traditional Christian values, where children are given every opportunity to fulfil their potential.

Welcome to Senior School -

▸

Sixth Form

St Lawrence College aims for educational excellence, and nearly all of the Upper Sixth will continue to Higher Education at University.

Welcome to Sixth Form

There are various ways in which you can make a donation to St Lawrence College below.

Regular Giving

Regular Giving

The generous donations from Old Lawrentians play a crucial role in enhancing the educational experience for current students at St Lawrence College. These contributions help fund scholarships, improve facilities, and support a wide range of extracurricular activities, ensuring students have access to the resources they need to thrive both academically and personally.

On the payment options page, you can specify where you would like your donation to go towards, whether it’s supporting scholarships, improving sports facilities, or enhancing classroom environments. Every donation, no matter the size, directly enriches the school and provides opportunities that shape the future of each student.

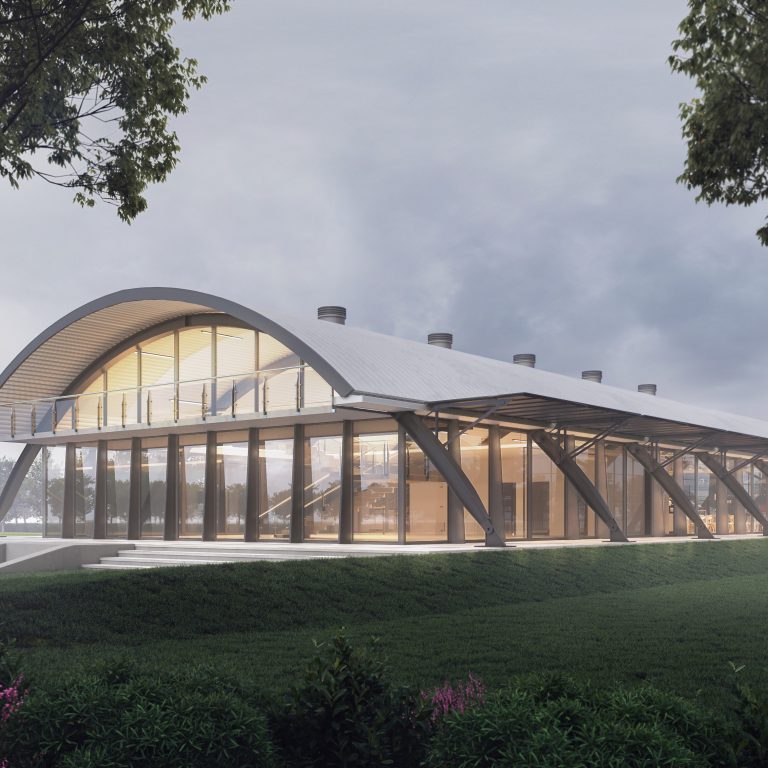

From sports pavilions to outstanding classrooms, your support helps preserve these vital traditions and continues to shape the legacy of the school. Thank you for making a lasting impact.

If you would like to make a regular gift, you can set up a Direct Debit by completing the form below and returning it to the Development Office at St Lawrence College, Ramsgate CT11 7AE

A Single Gift

Donations

Donations to St Lawrence College are essential for sustaining a vibrant, inclusive community. Contributions improve facilities, fund scholarships, and support enriching programs in academics, arts, and sports. Your generosity empowers students to achieve their best and helps uphold the legacy of St Lawrence for future generations.

On the payment options page, you can specify where you would like your donation to go towards, ensuring that your contribution has the greatest impact in the areas that matter most to you. Whether it’s supporting a specific program or enhancing The College facilities, your donation will directly benefit the school’s growth and students.

Thank you for making an impact.

If you are a UK tax payer, please complete the Gift Form and the Gift Aid declaration. This will increase the value of your donation by 25 pence for every £1 donated at no cost to yourself.

Should you wish to automatically complete the Gift Aid Declaration please click here to fill out the form.

Gift Aid

As a registered charity St Lawrence College can reclaim the tax (20%) on any donation from a UK tax payer through Gift Aid. If you are a higher or additional rate taxpayer you can personally reclaim the difference between your rate and the 20% basic rate of tax through your HMRC Self Assessment form.

Simply tick the box marked ‘Gift Aid’ on the form attached, sign and return by post or email.

| Single Gift | Value to St Lawrence with Gift Aid | Actual cost for a higher rate (40%) tax payer | Actual cost for an additional rate (45%) tax payer |

| £4,000 | £5,000 | £3,000 | £2,750 |

| £800 | £1,000 | £600 | £550 |

| £400 | £500 | £300 | £275 |

| £80 | £100 | £60 | £55 |

Payroll Giving

Payroll giving is a highly tax effective way of supporting a charitable cause. It means that you give to a charity from your gross salary (before tax is deducted) and receive immediate tax relief.

How does it work?

Donations are taken from your gross salary which means that your gift costs 20%, 40% or 45% less according to your tax bracket.

For example

If you are a standard rate tax payer (20%), a gift of £10 per month to St Lawrence College will cost £8

If you are a higher rate tax payer (40%), a gift of £10 per month to St Lawrence College will cost you £6

If you are an additional rate tax payer (45%), a gift of £10 per month to St Lawrence College will cost you £5.50

Gifts can also be made regularly – e.g. monthly, quarterly or annually – or on a one-off basis.

Why should I give through my payroll?

Payroll Giving is an easy, tax-effective way to give so it costs you less to give more.

What do you need to do?

As St Lawrence College is recognised by HMRC as a registered charity (No. 307921), all you need to do is ask your payroll department to deduct regular charitable donations from your salary. You will need to complete a simple mandate form, stating how much you would like to give and to which charities. Your employer will forward your completed form to its chosen Payroll Giving Agency which manages all employees’ payroll giving and deduct your chosen amount from your pre-tax salary. The Payroll Giving Agency will distribute the gifts at agreed intervals to the College. Your donations will show on your payslip.

What does my employer need to do?

If your employer does not already have a Payroll Giving scheme in place, don’t worry – it’s quick and easy to set up. Employers sign a contract with a Payroll Giving Agency who will transmit donations on their behalf.

Contact the Development Office on +44 (0)1843 572929 or email stlawrencedevelopment@slcuk.com to find out more about payroll giving today.

For more information visit www.payrollgivingcentre.org.uk.

Does it cost anything?

PGAs make a small charge to cover their costs. All PGAs are registered charities and make on profit from administering Payroll Giving donations. An increasing number of employers (including St Lawrence College itself) pay the PGA’s charges so that the full amount goes to charity.

Will my details be passed to St Lawrence College?

We will always try to write a thank you letter and tell you how about the impact of your giving. However the information you provide is protected under the Data Protection Act and can only be used for the purpose for which it was given.

Stocks and Shares

There are benefits for both the donor and the College when shares are given. Please contact the Development Office on +44 (0)1843 572929 or email stlawrencedevelopment@slcuk.com for further information.

Company Giving

We welcome the opportunity to work in partnership with local and UK companies.

All companies can get tax relief when they give money to UK charities, although the relief works differently for companies, self-employed people and partnerships. Many companies will match an individual employee’s gift to a charity.

If someone is self-employed and wants to Gift Aid their donation it is handled in the same way as a donation from an individual.

For further details please view:

http://www.hmrc.gov.uk/businesses/giving/companies…

http://www.hmrc.gov.uk/businesses/giving/self-empl…

Gifts left to St Lawrence in your Will are highly tax-effective and in the future are likely to provide substantial funds to support the College’s longer term objectives. As this would be exempt from inheritance tax, a donation made in your will can also reduce the tax burden on your estate.

How does it work?

A charitable legacy could be a gift of money or of any other assets. While there are a number of options to consider, there are two main types of charitable legacies:- pecuniary and residuary. Pecuniary legacies specify a sum of money or item of value to be donated, whilst a residuary legacy allows you to donate a percentage of the net value of your estate or the remaining sum after you have made provision for your family and friends.

What do you need to do?

To leave a legacy to St Lawrence College you simply need to include details of the donation in your will. This can be done by writing a will, by making an amendment or ‘codicil’ to an existing will or by setting up a Trust. Contact us to find out more about leaving a legacy to St Lawrence College.

For more information about the St Lawrence 1879 Legacy Society, please contact the Development Office on +44 (0)1843 572929 or click here to view the latest Legacy brochure.

International Donations

USA Residents

There are substantial tax benefits available to US taxpayers by giving to Charities and Foundations, but such bodies must be recognised by the Internal Revenue Service (IRS) and based in the USA.

In order to allow our US taxpayers to donate to St Lawrence College without removing these benefits, we have registered with the British Schools and Universities Foundation, Inc. (BSUF), a US registered charity. Contributions are deductible for Federal income tax purposes. Bequests, legacies, devises, transfers or gifts are deductible for Federal estate and gift tax purposes.

BSUF operates a reliable system under which monies are properly transferred to the Foundation. For further information on the BSUF or donating, please use the following link: https://www.bsuf.org/donate

Alternatively, complete the BSUF section of the Gift Form and return to the Development Office at St Lawrence College, Ramsgate, Kent, CT11 7AE or by email to stlawrencedevelopment@slcuk.com.

CAF

Single gifts of any amount can be made by cheque or Charities Aid Foundation (CAF) voucher. Please make all cheques and CAF vouchers payable to St Lawrence College and send them to the Development Office. The School receives no extra tax benefit from gifts made by cheque or CAF voucher. Please visit www.cafonline.org for more information.